Existing shareholders also support raise off the back of 300%+ growth in 2022

Mutinex has announced a $5m seed extension round, led by Equity Venture Partners. EVP are a well known and regarded venture capital investor, having previously invested in businesses like Insite AI, Siteminder, Deputy and Shippit amongst others. EVP is known as an extremely disciplined venture capital investor.

Mutinex is already a leader in marketing investment analytics in Australia, having set out to build an updated Bayesian model to understand growth. Mutinex built its flagship software product, GrowthOS, off the back of this model to provide growth leaders with clear decision support infrastructure.

Mutinex counts 20+ enterprises on its books including Intuit Australia, Youi Insurance, ING, Bendigo Bank, ME Bank, Asahi Oceania and Samsung Australia. The business has over 30 staff and is considered a leader in the fields of marketing measurement, ROI and insight.

Existing shareholders return

EVP’s Justin Lipman joins the Board of Mutinex, which is chaired by Brodie Arnhold. Arnhold chairs iSelect, Endota and Hungry Hungry amongst others. Lipman commented, “Mutinex as a business has the potential to transform the entire marketing industry. With a clear vision as to how to create the Bloomberg of Growth, supportive by a well disciplined management team, it’s clear Mutinex has the potential to become the dominant market leader in this category. When we reviewed the business in due diligence, it was clear the team weren’t just exceptional product operators but deeply understood how to create a sustainable business with exceptionally strong unit economics. We are thrilled to partner to help them become the leader in Marketing Investment Analytics.

Existing shareholders including Bloomsbury Information Capital also invested in the round off the back of outstanding performance against goals set in previous rounds. The business set a goal of 200% revenue growth in the calendar year 2022 and achieved in excess of 300%. Strong support from returning investors and the extremely high valuation are additional factors that validate Mutinex’s rapid growth plans. Returning investor Chris Savage says, “The most critical factor for me with Mutinex is the people. Brilliant, driven leadership supported by an outstanding team. Yes, it’s the right, much-needed product suite at the right time to add real value to marketers. As an investor, the decision to back this team again was easy.”

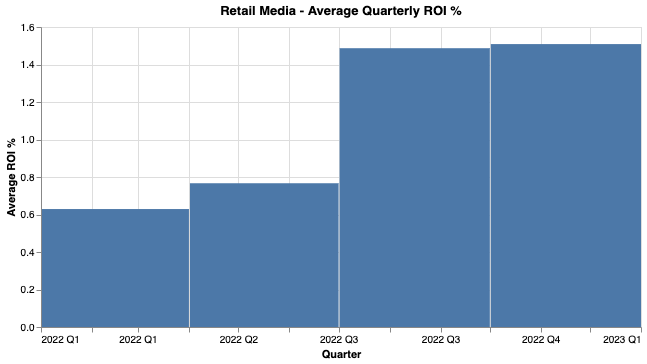

Russel Howcroft is another returning investor with an eye on performance. The recent AdNews advertising hall of fame inductee says “With a business like Mutinex, it’s the numbers that matter. A brilliant platform, with greater than 50% quarter on quarter growth, market leading technology and talent – little wonder Mutinex averages 5 users, using the platforms a minimum of 5 times per week. Daily usage among significant enterprises. Like it, I love it.”

Henry Innis, CEO of Mutinex, commented: “It’s extremely exciting to have an investor of the calibre of EVP joining the Mutinex journey. Our seed extension round now values the business at $37m, representing significant value creation for our shareholders and endorsement as to the scale and potential of Mutinex going forward. Frankly, we can’t wait to get moving further.”

Plans to scale

“Mutinex will now be investing in scaling self service onboarding tooling, our state of the art recommendation engine and our enablement/account management functions. Given EVP’s strong track record with B2B SaaS companies, we believe they will add significant value in showing us patterns to follow to get this business to the $1bn of scale we believe it can achieve. We will also continue to expand our US presence with investments in Customer, Engineering and local Account Management to be announced”.

“We will be looking to add another 30 people in short order, and are looking to scale to 50 people prior to year’s end. It’s an extremely exciting time to be joining the market leader for investment analytics, and we are thrilled to continue to expand our vision of organizing complexity to surface high investment return decisions.”

Simon Benney, Managing Partner at Kernow Advisory says: “Mutinex continues to impress with strong growth and exceptional potential. The team has added to their already impressive client portfolio, attracting more blue chip companies and boasting sustained success with existing customers. The brilliant product development track record also continues at pace, with an exciting flow of innovative product features being integrated into the core product. The AI based Recommendation engine is going to fuel a new wave of value for increasing return on marketing investments and it’s very exciting to see this coming to market”

Law firm Addisons, led by Kieren Parker and Sophie Evans, advised and negotiated on behalf of Mutinex for the round. Commenting, Kieren Parker said “Congratulations to Co-founders Henry Innis and Matt Farrugia in securing this $5million funding round. Mutinex continues to go from strength to strength with GrowthOS, a sophisticated analytics platform for companies to measure the financial return of their digital marketing spend. Closing this round – led by VC EVP and well supported by existing and new investors – in an investment climate that has otherwise turned significantly more cautious since Mutinex’s last funding round in mid-2022 is no mean feat, and gives Mutinex real momentum.”