Brace for impact

What happens to marketing in a recession? For example, going in to 2023, we’re seeing some of the most disruptive economic market conditions ever. Climbing interest rates, inflation, possibly a recession – even the most experienced marketers couldn’t be blamed for being spooked. The challenge with MROI is that we’re always all chasing more, but that external market conditions can have an outsized impact on results. So instead of trying to increase MROI with marketing during a recession, we think the smart marketer will shift their mindset into MROI protection.

How can you best protect your MROI? First of all, start modeling and measuring your MROI. If you’re already doing that (congrats! Maybe you’re already a Mutinex customer using GrowthOS?), then really seek to understand the external drivers that will influence your modeling this year. And finally, socialise your modeling appropriately with the c-suite to garner confidence.

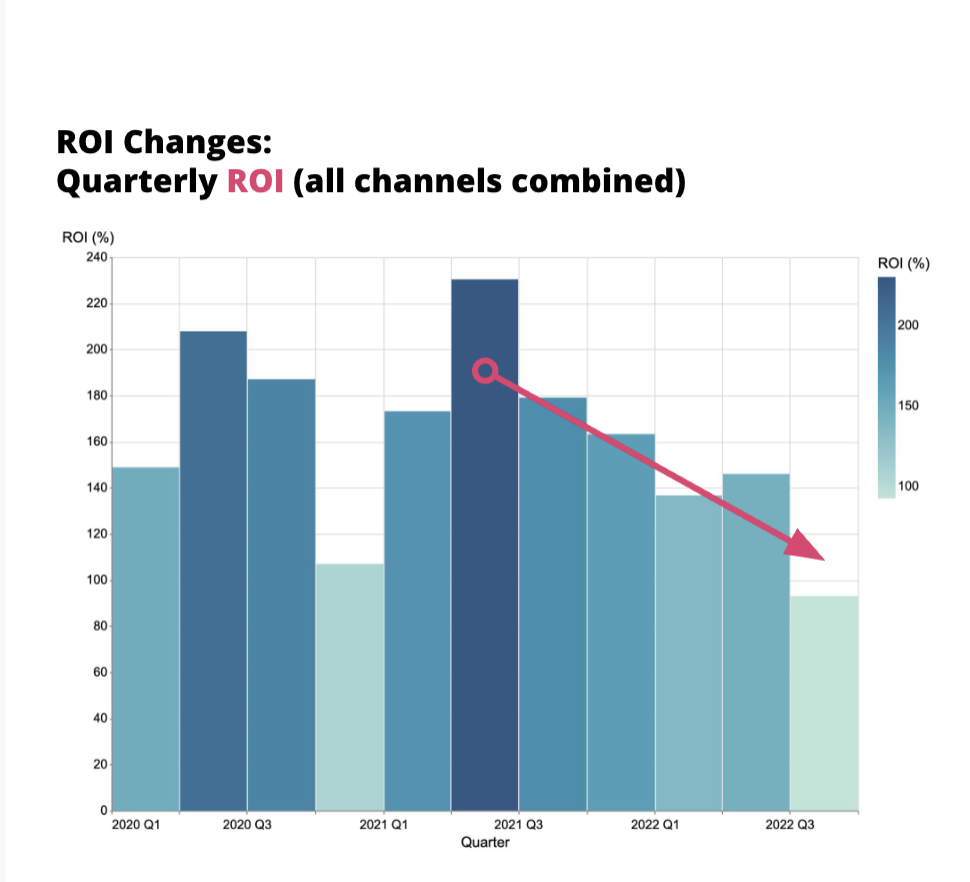

What external factors should you be looking for? At Mutinex, we’re seeing three key trends emerge through marketing data: ROI’s deterioration (which we expect to continue into 2023), the increased role of price and the increased competitiveness (and corresponding ROI hit) in performance media.

Expect MROI to halve in 2023

In 2022, we released ROI data as part of a half year snapshot at the IA’s Measure Up conference.

Typically strong paybacks in MROI are between 200% – 300% across the market within our models. Exceptional brands may exceed this. But in 2023 (and in similar years), we would expect this number to pull back to closer to 100%.

The underlying driver in this loss is a combination of two elements:

- Price competition. As consumers get more sensitive to value, brands discount and rely on pricing levers to drive consumer response. This erodes the return value on the remainder of marketing activity

- Shifting spend to easy to measure channels. Most marketers lack strong MROI analytics, and so shift spend to easy to measure channels with pixel measurement. This leads to intense competition as brands compete in the same, undifferentiated channels.

Is your price right?

Pricing will likely play a bigger role in the market than it has for some time. Brands need to first understand how pricing impacts their results and then get their pricing strategies right. Across 2023 this will become one of the most impactful levers to pull if you’re able to align your strategy with the twin pressures of increasing interest rates and inflation.

In the same IAB conference, we released a long-term cash rate forecast model for brands. (economic forecasting for brands is now crucial – without it, brands live in uncertainty about where they are extracting value).

The data analysis confirmed two critical pieces of speculation

- Throughout the COVID pandemic, inflation took a back seat to the pandemic in terms of factors impacting brand sales. But with COVID (economically speaking), in the rear view and inflation on the rise, we’re seeing that inflation is becoming more damaging than COVID to sales performance

- At the time of our data analysis, the cash rate was (still) offsetting this with stimulus effects. But now the cash rate is going up (in case you hadn’t noticed). As the cash rate nears 4%, our modeling suggests that more brands will be impacted.

Price, inflation, interest rates. These are all factors that play into each other with unique outcomes for every brand. Every marketer should have a strong pricing strategy for the year ahead to avoid getting caught out by major fluctuations.

Performance media to lose up to 10% in incremental sales

We’re seeing interesting and early signs that ROI in performance media is dipping. Channels such as Search and Retargeting are starting to get less incremental revenue dropping through them. Reading the data, ROI dips could represent as much as a 10% in incremental sales.

Why will performance channels start to fail us in this environment?

- Most marketers are removing budget from brand (which often has strong halo effects to performance channels – it’s not brand OR performance, it’s brand AND performance)

- There are less buyers in-market for some product lines

- More marketers are competing for highly performance driven assets, which can have the effect of more competition as people compete for sales volume (which, ironically in a programmatic market, comes at the expense of margin)

When times are tough, it’s tempting to shift investment to channels where it’s easy to demonstrate sales. But just because performance channels are measurable doesn’t mean they’re providing the best MROI.

What can smart marketers do during a recession?

Managing Director, CHEP Network, Jonny Berger notes marketing practitioners and everyday Australians, we should all find the trends that the team at Mutinex are predicting for 2023 a little concerning. Thankfully, the data is always a starting point – it’s what we do with it that matters. Applying intellect and creativity to architect solutions based on these insights is where market advantage will be found.

We think that the major strategy in 2023 and similar years should be to focus on leveraging data to make smart cuts, minimise the impact of budget declines and manage the message internally – marketing is still effective in a recession.

In a nutshell:

- Ensure you have a robust and holistic MROI model.

- Use that model to cut elements of budget not delivering incrementally and to defend brand budgets delivering incremental value.

- Consistently communicate MROI to stakeholders to reinforce the marketing effectiveness message through sales declines

This article originally appeared in Mi3.