Or everything you’ve ever wanted to know about marketing ROI

Often at Mutinex we’re asked a key question: what is a good marketing ROI and why?

It’s a loaded question that’s hard to answer. But why? What do we actually consider when we talk to customers about their media performance?

We think it’s helpful to consider marketing investment analytics through three key lenses, which is what we’d use to advise clients when telling them if their performance was ‘good’:

- The opportunity cost of the media or marketing investment

- The efficiency (or the %) return

- The net or incremental revenue generated by the marketing activity

What is the meaning of ROI in marketing?

Before we dive into what “good” ROI on marketing looks like, let’ define the term. Marketing ROI, or Return on Investment, refers to the measurement and evaluation of the effectiveness and profitability of marketing campaigns or initiatives. It is a financial metric used to assess the return generated from the resources invested in marketing activities. ROI for Marketing is crucial because it provides businesses with valuable insights into the success and efficiency of their marketing efforts. By tracking and analyzing ROI, companies can determine which marketing strategies are generating the highest returns, enabling them to make informed decisions, allocate resources effectively, and optimize their marketing budgets. It helps organizations to justify their marketing spend, identify areas for improvement, and align their marketing efforts with their overall business goals. Ultimately, marketing ROI plays a pivotal role in driving business growth, enhancing profitability, and maximizing the impact of marketing activities.

There are multiple ways for marketers to measure marketing ROI. In the past, ROI was only measured at a large scale by teams of consultants who delivered a static report. Mutinex provides next generation marketing mix modeling with our SaaS platform solution, GrowthOS. A SaaS platform solution to marketing mix modeling like GrowthOS allows our customers to bring marketing ROI data closer to decision-makers and iterate their marketing investment strategies quickly. Basically, the proximity of data allows our customers to get closer to what “good marketing ROI” looks like for them faster.

Opportunity cost of the marketing investment

Opportunity cost is a fundamental question when it comes to ROI. Effectively, it means ‘what else could I have spent the money on that’s better’. If there’s nothing else to spend it on, and you’re making money, then typically it’s a good idea to spend.

But in business that’s never the case. Shareholder dividends, product R&D, other brands… even customer support all have budgets that are essentially competing for the same share of company costs. That’s at the essence of zero based budgeting.

So to consider the ‘good marketing ROI’ or effective media performance question, you should ask what else the organisation could have spent the money on. Was there an alternative to spend? If so, would it have delivered a better shareholder return in underlying value? For marketers, it’s a question they mostly don’t consider. But every dollar spent in media has an opportunity cost, and so it’s important to set the context of how you’re spending money.

Efficiency of return

We’re not fans of ‘efficiency’ as a metric in and of itself. But it is useful to understand the rate of return in media investment analytics. The critical element is the % return is an efficiency metric, or a metric that points to how much that dollar returned.

Efficiency by itself is misleading. Why?

Mostly, efficiency doesn’t equal opportunity. A brand with a small spend might be remarkably efficient in terms of marketing investment ROI, but a big brand may be the brand that brings the bucks in at scale. The % isn’t enough – it doesn’t speak to the total size of the opportunity; and the small sample sizes with high returning percentages very often confuse marketers.

That gets even more complex when you break down into channels. There are a few reasons for this: firstly, channels

Let’s start with digital efficiency.

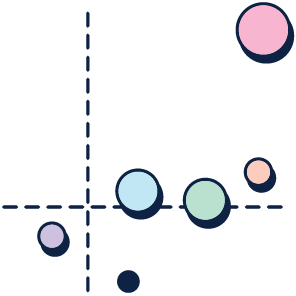

Most successful or high ROI activity will occur at small scales. Most digital media for example exhausts high-value targets in programmatic before moving onto bigger, less efficient markets. It makes the initial CPAs, or at least the ones that appear after programmatic targeting kicks in, look appealing but perform poorly at scale.

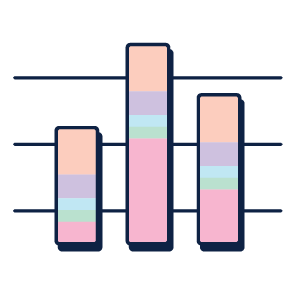

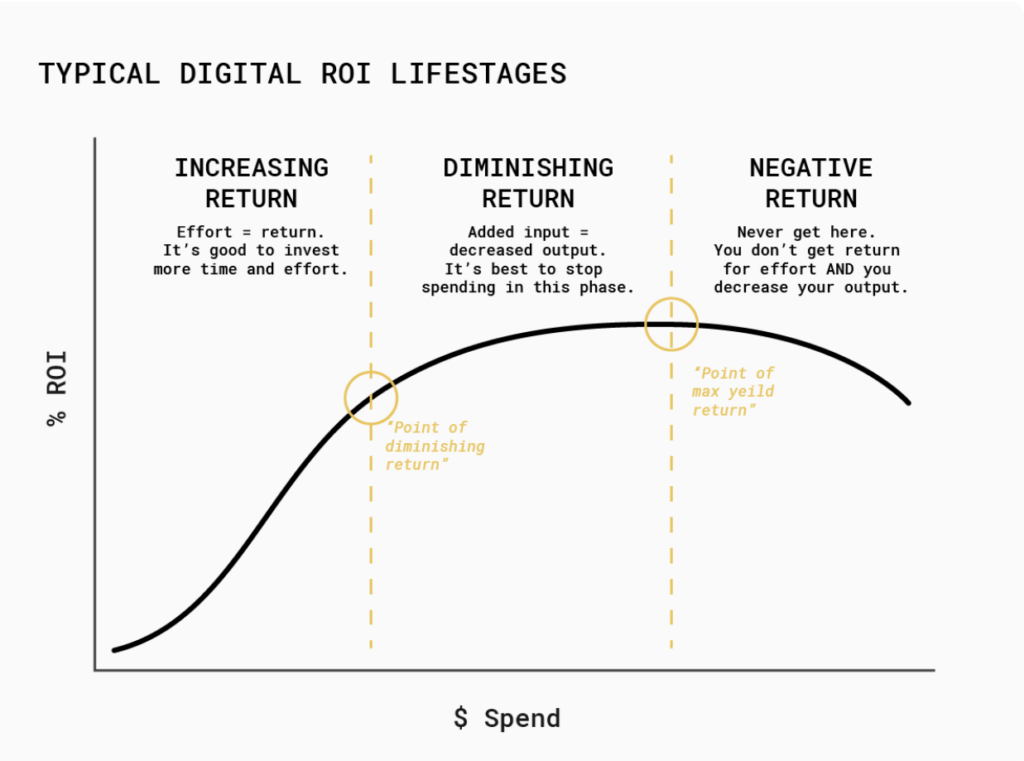

Digital tends to look like this as a result when it comes to % ROI (right).

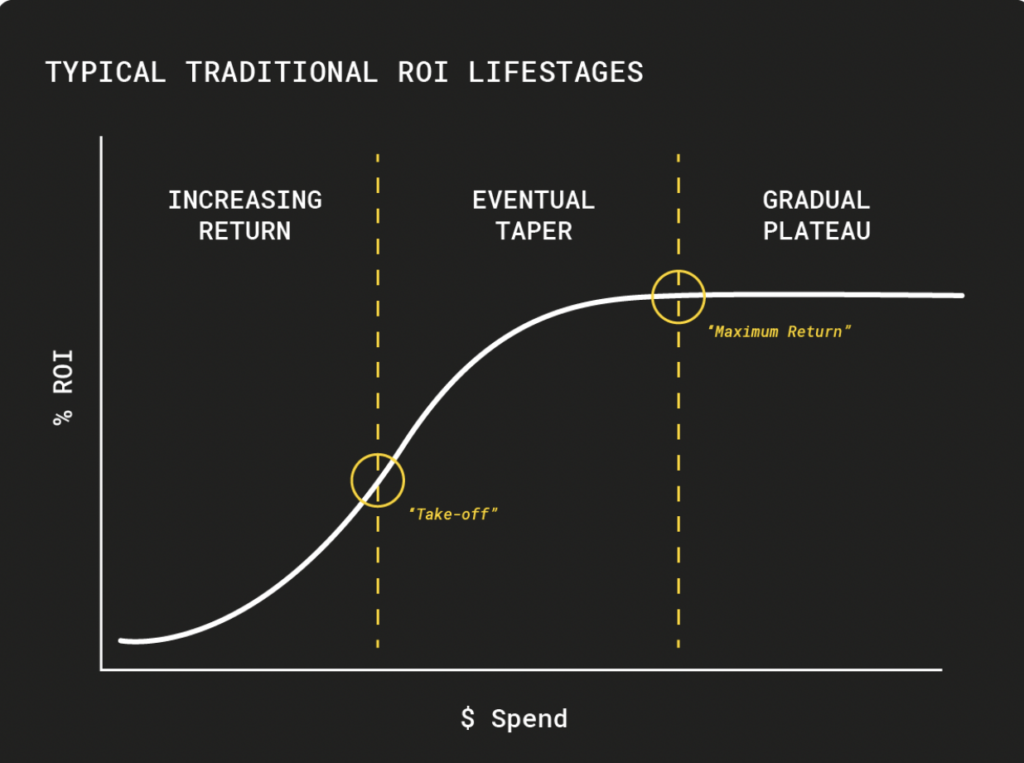

Contrast that to more traditional or brand-building media (including OLV, BVOD and other ‘digitally bought’ channels that behave closer to traditional media), which tends to operate on an S curve. That means media ROI in these longer-term channels tends to look small at small scales, before accelerating and then tapering off (below)

What does all this mean? A couple of things:

- High ROI doesn’t necessarily mean ‘good’

- Low ROI doesn’t necessarily mean ‘bad’

Instead, part of the job of humans is to assess what efficiency means in context. This leads to the next key question: scale and incremental revenue.

Net or incremental revenue

To assess media performance, we don’t just need to optimise for efficiency. We also need to optimise for scale. Scale means incremental / net revenue – basically, how much money are we dropping back to the bottom line over and above what already would have happened.

ROI is only valuable when it operates at an effective scale. For most brands, scale means investment in television and brand building channels is a must, simply because they operate more effectively at scale over longer periods of time.

We shouldn’t just be focused on efficiency, but on growth numbers as well. If incremental growth and revenue isn’t being created then there’s very little value being created.

So you need to ask yourself when you’re asking whether or not your ROI is good: is this an effective scale to make decisions from? Scale matters, and being efficient at small scales can often lead to bad decision making when it comes to talking about ROI.

In summary…

Figuring out what your marketing ROI should be is difficult. At Mutinex, we’ve consistently seen that an overemphasis on efficiency without the opportunity cost and scale/net revenue context can lead to numbers being interpreted incorrectly.

But without knowing your ROI, it makes it hard to make a case in the boardroom as to why you should be trusted with money. That’s why a strong media investment analytics platform like GrowthOS, alongside a strong knowledge of how to present numbers and figures in context, is critical for marketers taking control of their financial narrative.